IMO2020

IMO2020 Will Bring Massive Shocks To The Marine Fuel Market

The sudden switch to low-sulphur fuel oils (LSFO) has caught refiners and shipowners by surprise and will result in higher prices and up to 3M bopd in increased demand for LSFO and marine gas oil (MGO).

New regulations set by the International Maritime Organisation (IMO) in 2020 will require ships to use fuel with less than 0.5% sulphur content (down from 3.5%). Although refiners have been trying to prepare for this change, they will not be able to meet it in time and will have to purchase LSFO and MGO instead.

S&P Global Platts predicts that this will result in up to 3M bopd in increased demand for LSFO and MGO, a number that is corroborated by BCG analysis.

Sources: S&P Global Platts, IHS Markit, and BCG

We Are Ready To Supply IMO2020-Compliant Fuel

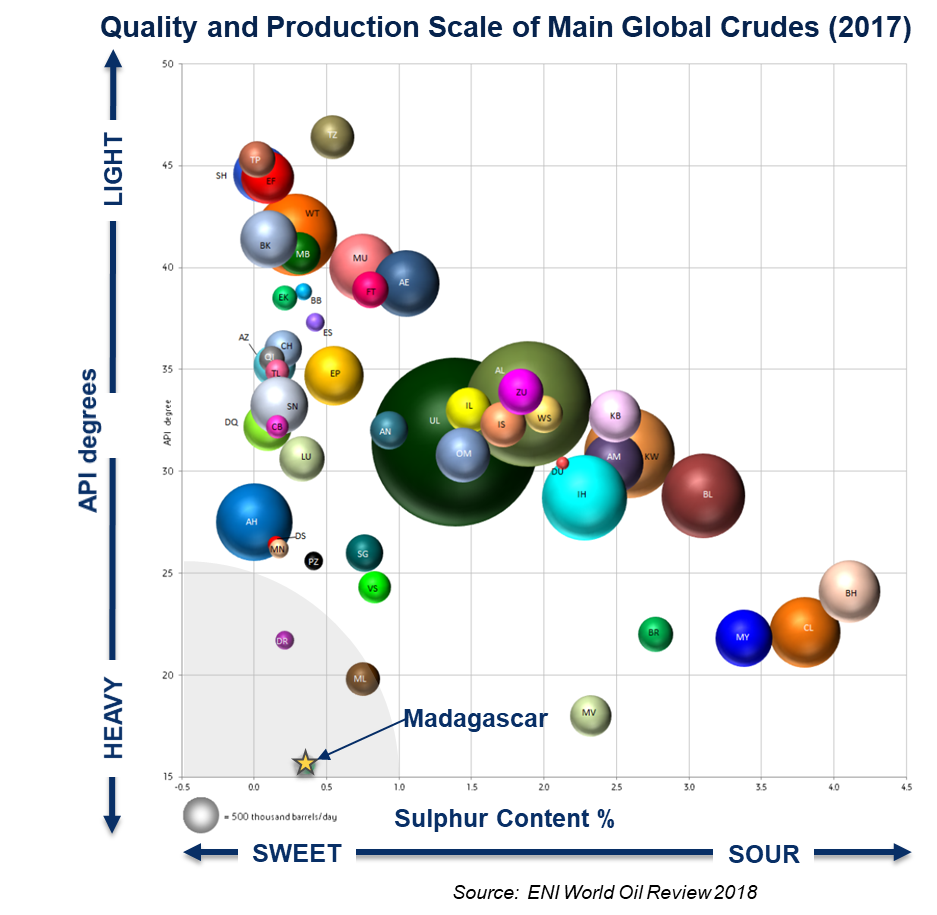

Tsimiroro’s very-low sulphur (0.3%) crude positions Madagascar Oil well for a post-IMO2020 world

Madagascar Oil will play an important part in this green transition, thanks to the very low-sulphur (0.3%) nature of its crude. It has one of the world’s largest, very-low sulphur oil reserves.

Heavy Sweet Crudes Are Scarce

At peak production, Tsimiroro could contribute a significant portion of global heavy sweet crude.

Whilst 35% of global crude production is sweet crude, only 2.5% is heavy sweet crude. Heavy sweet crude exports are only about 1% of total waterborne crude exports. Heavy sweet crude is a key feedstock for producing Very Low Sulphur Fuel Oil, either through simple blending operations or through refining. Highly stable crudes such as Tsimiroro are well suited to direct blending to create VLSFO and therefore can by-pass the refinery process.

Due to the scarcity of heavy sweet crudes, the increased demand for VLSFO, and the ability to blend directly to VLSFO, these crudes can trade at over US$10 premium to Brent.